Commercial mortgage how much can i borrow

A Buy to Let mortgage is a loan secured against one of these properties. Payday loans have high fees that can equate to annual percentage rates or APRs of around 400 much higher than personal loan APRs which average around 10 to 11 for a 24-month term according to the Federal Reserve.

Tips For First Time Home Buyers Applying For A Mortgage In 2022 Successful Business Tips Real Estate Quotes Home Buying Tips

How much can I borrow with an accounting practice commercial loan.

. A mortgage broker can help you get approved and borrow the amount you need. Commercial Mortgage Interest Rates. What mortgage can I get for 500 a month in the UK.

Most commercial mortgage facilities charge a lender arrangement fee also known as a facility fee acceptance fee or booking fee which is usually a percentage of the mortgage amount being borrowed and added to the facility. If the property requires substantial repair traditional lenders like banks will often not lend on a property and the investor may be required to borrow from a private lender utilizing a short term bridge loan like a hard money loan from a Hard money lender. If applicable please enter the arrangement fee as a percentage this will then be added to the total mortgage facility.

This mortgage finances the entire propertys cost which makes an appealing option. Loan to Value LTV This is the amount of the mortgage expressed as a percentage of the property value. 31000 23000 subsidized 7000 unsubsidized Independent.

Paying 500 a month over 25 years means you are paying back 150000 but your mortgage will also include interest - which is charged per. A Buy to Let property sometimes referred to as buy to rent or BTL is a type of property investment in which the investor becomes a landlord and rents out the property for profit. What assets you have to offer if you need collateral.

Lenders mortgage insurance LMI can be expensive. After performing the calculation you can transfer the results to our mortgage comparison calculator where you can compare all the latest mortgage rates. Brokers partner with a variety of lenders including commercial banks credit unions mortgage companies and other financial institutions and can work independently or with a brokerage firm.

Like any form of investment theres a lot to consider before you make the jump as. You can typically borrow between 25. Knowing exactly how much you should borrow should be something you should figure out before seeking.

Hard money loans are usually short-term loans where the lender charges a much higher. The first step in getting your business off the ground is getting approval through a lender. Their fee is normally up.

Because your bridging lender knows that you will repay your loan as a lump sum through an entire mortgage they can release the funds within 28 days in most cases. What your loan to value ratio LVR is. You can get a 100 commercial loan with equity in an existing property a guarantor business assets or a combination of all three.

Please get in touch over the phone or visit us in branch. Gifts or loans from relatives and programs like an 801010 combination loan can help you avoid PMI. Costs associated with getting a mortgage.

Enter your details in the calculator to estimate the maximum mortgage you can borrow. 801010 loans consist of a first mortgage 80 and a second mortgage 10 that total 90 of the purchase price and a 10 down payment. Bridging loans can be arranged very quickly under the agreement that you will later refinance with a standard mortgage.

Most commercial mortgage amounts range between 150000 and 5000000. While every mortgage lender has their own criteria for determining how much you can borrow they all look at the following key factors when calculating a buy to let mortgage. Mortgage calculators can be useful to get a rough idea of your total borrowing but keep in mind that they are unable to take into account your personal circumstances and therefore there may be additional factors that affect the actual amount you can borrow.

This time frame is too short for a standard mortgage. What is a Buy to Let mortgage. Borrowers also can release their co-signers after 36 monthly payments and graduates can refinance federal PLUS loans in their own names that their parents took out.

How much youre able to borrow depends on your net operating income the type of real estate youre using as collateral and your propertys value in comparison to the loan amount. Lending money to a trust to cover these expenses is a faster and easier option than having the trust sell assets. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

If you bought a 600000 house with a 5 deposit of 30000 then your LMI premium could cost over 22000 based on Finders LMI estimator. Extra Details Loan terms. If you own your car you may be able to take out a car title loan.

A successor trustee can encumber real estate assets owned by the irrevocable trust in order to raise the needed funds if allowed by the trust documents. However as a drawback expect it to come with a much higher interest rate. Were able to lend on alternative asset types and ownership structures including Delaware Statutory Trusts and commit to upfront interest rates and spreads even in the context of earn.

Total subsidized and unsubsidized loan limits over the course of your entire education include. But ultimately its down to the individual lender. Mortgage calculator UK - find out how much you can borrow.

See the average mortgage loan to income LTI ratio for UK borrowers. Mortgage loans to irrevocable trusts can be funded in as few as 5-7 days. Know your limits for finance and your ability to repay any money you borrow.

Who will be willing to guarantee your loan if you need a guarantor. What maximum repayment you can afford. Use our mortgage calculator to see how much mortgage you can get in the UK how much mortgage you can afford and how much deposit you need for a mortgage.

Calculate your monthly mortgage repayments to see what you could afford to borrow when moving house remortgaging or buying your first home. Commercial insurance Self employed public liability insurance Van insurance Taxi insurance Shop Insurance Builders. Calculate how much you can borrow.

Not only can we offer permanent loans on stabilized assets up to 15 years but we can also work with the unique circumstances of transitional properties. You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit. These mortgages are a way for businesses to borrow over a certain amount say 25000 with the lender using your business property as security.

Chances are you will have to acquire a commercial mortgage in order to give you the borrowing power to fund your inventory and pay for receivables. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. If you need the money up-front or on a needs basis.

A specialist commercial mortgage broker can help you find the best deal and will present your application to the lender to increase its likelihood of being accepted.

Guarantor Home Loans Borrow 105 Home Loans The Borrowers Home Buying

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

Infographic 10 Steps To Buying A Home In The Uk Home Buying Infographic 10 Things

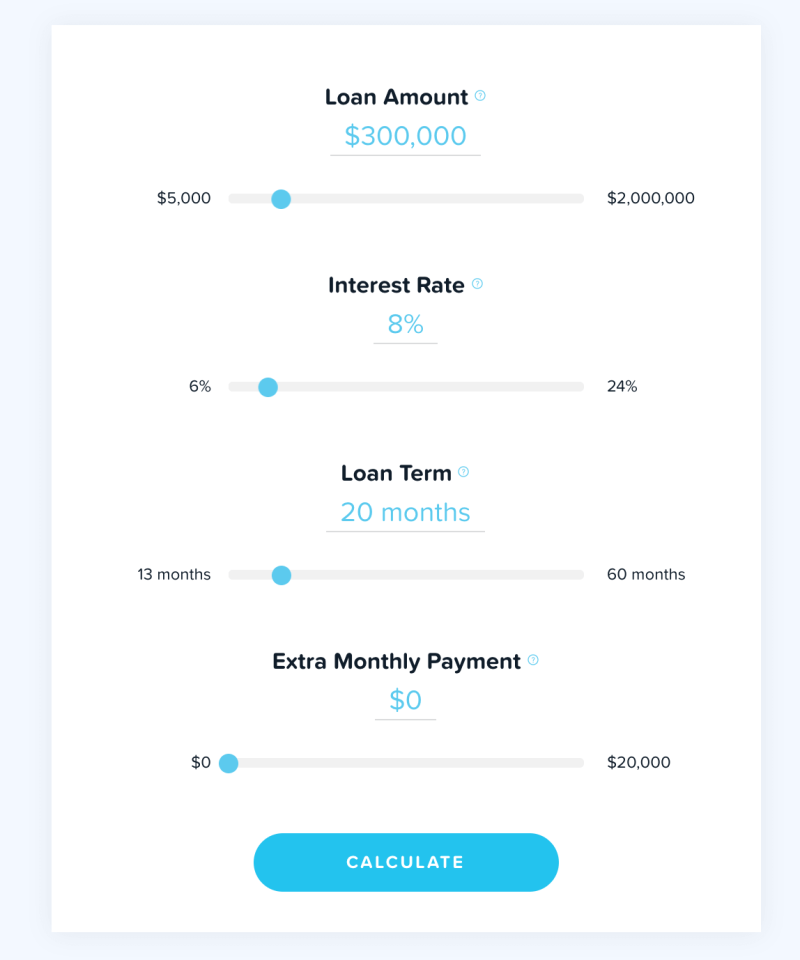

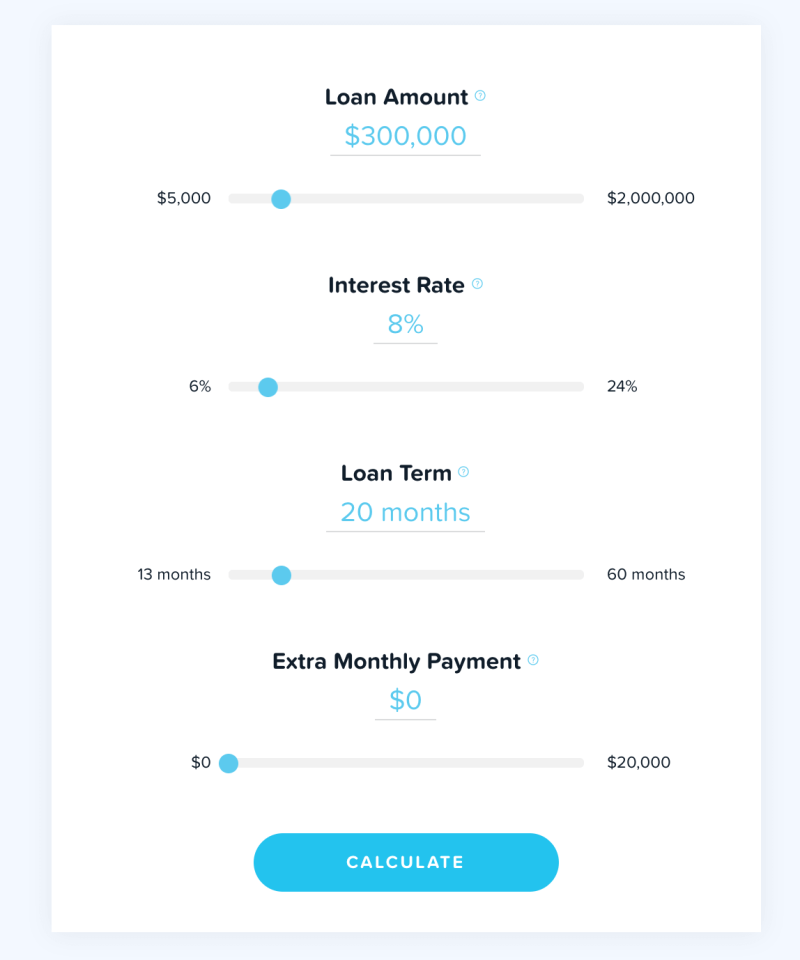

Easy Commercial Mortgage Payment Calculator Lendio

The Power Of Mortgage Pre Approval Infographic Preapproved Mortgage Mortgage Mortgage Loans

Did You Know You Can Borrow For Major Expenses Like Education Expenses Home Renovation Or Weddings Through Ho Home Equity Home Improvement Loans The Borrowers

Mortgage How Much Can You Borrow Wells Fargo

Use The Interactive Home Loan Calculator To Calculate Your Home Loan Emi Mortgage Amortization Calculator Mortgage Loan Originator Mortgage Payment Calculator

Self Employed Mortgage How Much Can I Borrow The Borrowers Self Mortgage

9 Reasons To Apply For Personal Loan Personal Loans Business Loans Best Online Jobs

Wondering How Much Home You Qualify For Interest Rates Have A Big Impact On Your Ability To Borrow Lea Fixed Rate Mortgage The Borrowers Real Estate Services

Didyouknow Realestatiekatie Real Estate Marketing Quotes Real Estate Business Plan Getting Into Real Estate

Pin By Ariana Jones On Money Moves Money Management Advice Best Money Saving Tips Financial Quotes

What Is Loan Origination Types Of Loans Personal Loans Automated System

Pin On Finance Infographics

Equitable Mortgage Registration Mortgage Mortgage Loans The Borrowers

Business Loans Flat Concept Icon In 2022 Business Loans Loan Concept