70+ how do i record a used supplies in transaction worksheet in accounting

In this category file documents related to planning design contract funding advertising and opening bids. Before sharing sensitive information make sure youre on a federal government site.

Supplies a listing of open accounts and their balances that are used in preparing financial statements.

. The financial statements of the citycountydistrict have been prepared in conformity with Generally Accepted Accounting Principles GAAP as applied to governmental unitsThe Governmental Accounting Standards Board GASB is the accepted standard setting body for establishing governmental accounting and financial reporting. Of a mineral nature. Federal government websites often end in gov or mil.

Chapter 7 homework answers intermediate accounting ifrs questions solutions chapter cash and receivables donald kieso jerry weygandt terry warfield brief. On December 31 2012 Santana Company has 7000000 of short-term debt in the form of notes payable to Golden State Bank due in 2013. There is a worksheet approach a company may use to make sure end-of-period adjustments translate to the correct financial statements.

Physically extracted in operations. It helps bookkeepers and accountants complete the accounting cycle and prepare year-end reports like adjusting trial balance and financial statements. Here we go- this form is long.

We would like to show you a description here but the site wont allow us. Advatech Office Supplies Ltd Soin Arcade Ground Floor Westlands. The accounting equation is balanced as shown on the balance sheet because total assets equal 29965 as do the total liabilities and stockholders equity.

A worksheet is a type of working paper used by an accountant as a preliminary step for preparing a financial statement. And Yes it is required for a quality comprehensive tax return for your small. Printing Plus has 100 of supplies expense 75 of depreciation expenseequipment 5100 of salaries expense and 300 of utility expense each with a debit balance on the adjusted trial balance.

19 Full PDFs related to this paper. The journal entry to record this entry would be aA debit to accounts payable for 1200 and a credit to supplies for 1200 bAdebit to supplies for 1200 and a credit to cash for 1200. When we write papers for you we transfer all the ownership to you.

The closing entry will credit Supplies Expense Depreciation ExpenseEquipment Salaries Expense and Utility Expense and debit Income Summary. This means that you do not have to acknowledge us in your work not unless you please to do so. Henry figures the depreciation using the modified accelerated cost recovery system MACRS.

On November 24th the following transaction took place. The gov means its official. Do not file documents in this category that apply solely or directly to.

The invoice also serves as a proof of the purchase made by the buyer. That can be used for reference or lending. An accounting record into which the essential facts and figures in connection with all transactions are initially recorded is called the.

If it is an academic paper you have to ensure it is permitted by your institution. These expenses can be claimed as a separate deduction on your Schedule C Form 1040. Net cash used in investing activities Purchase of intangible assets Purchase of land 8-89 P 34000 130000 Chapter 8 Cost Concepts and Classifications Purchase of equipment Purchase of building Sale of land 60000 100000 165000 P159000 3.

This worksheet shows the information used in figuring the depreciation allowed on assets used in Henrys business. The ending balance in the Supplies account after the adjustment was 12000. Other non-cash assistance 414590 Food stamps food commodities vaccines donated property including surplus and other non-cash assistance should be valued at fair market value at the time of receipt or the assessed.

Category 11 Information Furnished at Start of Project. Davis Company purchased 1200 of supplies on account. Despite the basis of accounting used by the grantee non-cash awards are reported in the fiscal year they are received.

A company purchased supplies during the year totaling 21000. Note 1 Summary of Significant Accounting Policies. To qualify as natural resources in the accounting sense assets must be.

Interpret the term signed under section 492 where a computer-based record system is being used. The method most commonly used to compute depletion is the. Generally accepted accounting principles.

The sales transactions in your business may be a simple cash sales or even sales on credit. The beginning balance in the Supplies account was. Requesting a Governement Audit of an Accounting and Billing System Requesting a ISO 9001 system in the SOW but having FAR 52-246-11 Required Government sources FAR 52251-1.

Every business involves sales of goods or services. The standard meal and snack rates include beverages but do not include non-food supplies used for food preparation service or storage such as containers paper products or utensils. At the end of the year they made an adjusting entry to record 16000 of supplies that had been used during the year.

Net cash used in financing activities Purchase of treasury shares Payment of dividends. When used enter the name of the category on the index sheet. On January 28 2013 Santana enters into a refinancing agreeme.

Business Worksheet to provide the information not contained in your accounting records. Describe the intent of section 493 and its use of reasonably available Application of section 49 Section 49 applies if another section of the Regulation requires a machine or piece of equipment to have an inspection and maintenance record. We do not ask clients to reference us in the papers we write for them.

Cost and Managerial Accounting - Barfield etal. Gross Floor Area should include all space within the buildings including circulation rooms storage areas readingstudy rooms restrooms. Library refers to buildings used to store and manage collections of literary and artistic materials such as books periodicals newspapers films etc.

The method used to record unsuccessful patents. He purchased and placed in service several used assets that. For each sales transaction you will need to keep a record of the items that you sold the payment that you received goods returned and so on.

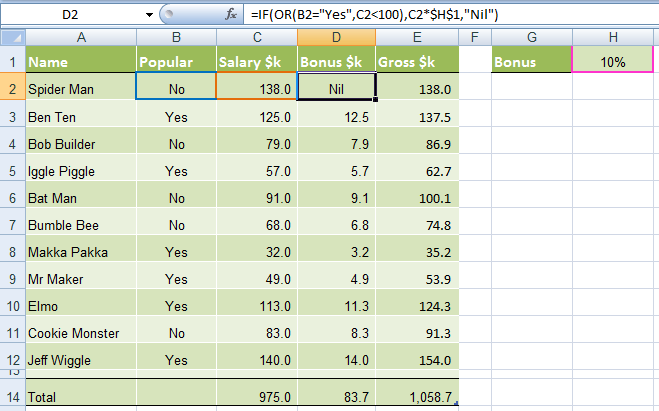

Excel If And Or Functions Explained My Online Training Hub

How Much Money Do The Top Income Earners Make By Percentage

Lifetime Cash Flow Through Real Estate Investing Podcast Addict

Frank Potter Organizational Biology Other Thoughts

Excel If And Or Functions Explained My Online Training Hub

Home Business Tax Deductions Are Just One Reason Of Many That A Home Based Business Is So Attrac Business Tax Deductions Small Business Tax Business Expense

The Manual Of Ideas The Superinvestor Issue By Beyondproxy Llc Issuu

Makeup Inventory Spreadsheet Spreadsheet Spreadsheet Template Makeup

Upgrading And Repairing Pcs Eleventh Edition Manualzz

80 Free Download Sign Up Sign In Sheet Templates Sign In Sheet Template Sign In Sheet Templates

Examples Of Case Studies Unique Case Study Format Example Of Case Study Case Study Template Case Study

Frank Potter Organizational Biology Other Thoughts

Quality Management System Of Uniliver Ghana Limited

12 Promissory Note Templates Word Excel Pdf Templates Notes Template Promissory Note Lesson Plan Template Free